Summary

Choosing between pursuing a college education or entering the workforce directly after high school is a pivotal decision that can significantly shape your future. This blog post delves into the most recent data from 2024 to compare the financial outcomes, career opportunities, personal development benefits, and social mobility prospects associated with both paths. We examine average earnings, unemployment rates, student debt, job market trends, and real-world success stories to provide a thorough overview that can aid you in making an informed choice. Additionally, we explore the likelihood of becoming a millionaire with or without a college degree, offering valuable insights into the long-term impacts of this critical decision.

Disclaimer: This post is for educational and informational purposes only and does not constitute financial advice.

Introduction

The question of whether to pursue higher education is more complex than ever. With escalating tuition fees, the burden of student loans, and a rapidly changing job market, it’s crucial to weigh the pros and cons of attending college versus jumping straight into the workforce. This comprehensive analysis will equip you with the information needed to make an informed decision in 2024.

Financial Outcomes

Average Earnings

Data consistently shows that individuals with a bachelor’s degree earn more than those with only a high school diploma. According to Elka Torpey (2021), the median weekly earnings for workers with a bachelor’s degree were $1,305 in 2020, compared to $781 for high school graduates.1 This $524 weekly difference can significantly impact your long-term financial stability.

Unemployment Rates

“In May 2024, the unemployment rate for high school graduates 25 years and older with no college was 4.3 percent; the rate was 4.0 percent in April. Over the past 20 years, the unemployment rate for this group has ranged from 3.3 percent in July 2023 to 17.7 percent in April 2020. The national unemployment rate was 4.0 percent in May 2024”

(U.S. Bureau of Labor Statistics, 2024, para, 1).2

This statistic underscores the long-term value of higher education for employment stability. While a college degree is not a guarantee against unemployment, it often provides access to a broader range of job opportunities, including roles in sectors more resilient to economic fluctuations, such as technology, healthcare, and professional services. For policymakers, educators, and job seekers, these insights can inform strategies to support workforce resilience and underscore the potential benefits of expanding access to education and skill-building programs.

Student Debt: While college graduates’ earning potential is higher, debt remains a critical concern (Hahn, 2024).

- “$28,950 owed per borrower on average”

. This debt can take decades to repay, impacting financial stability and the ability to invest in other areas such as homeownership and retirement savings. I remember graduating from college with $10,000 worth of debt. I was laid off (2008) and had to get credit cards to survive. It was not a fun time, but it woke me up early to the reality of having student loan debt.

Honestly, I didn’t earn a degree, though, and I wish I had more certifications and training and reached higher. The data shows that the degree will help you without a doubt. But why do we see videos telling so many people not to worry about degrees?

Unfortunately, many people today seek shock value that makes them go viral. Many people are looking for something different to post a video on to change minds, and it makes excellent shock value.

Degrees in Demand in 2024

Knowing which degrees offer the best return on investment is essential when considering college. The U.S. Bureau of Labor Statistics (BLS) indicates that fields like healthcare, technology, and business are in high demand. Degrees in nursing, computer science, and business administration are particularly sought. On the other hand, degrees in fields like anthropology and archaeology may offer fewer job opportunities (Bureau of Labor Statistics).

Note: Your passion for a field should also significantly influence your decision. Success often comes more accessible when you’re genuinely interested in your study area. Make sure there is plenty of room for growth before making this decision.

Career Opportunities

Job Market Trends

Specific industries continue to favor college graduates for entry-level positions. Healthcare, technology, and engineering sectors often require at least a bachelor’s degree. However, skilled trades such as plumbing, electrical work, and manufacturing offer lucrative opportunities without a college education (Greenberg et al., 2024).3

Emerging Opportunities: A study by McKinsey & Company (2024) highlights the growing demand for skilled trades, noting that annual hiring for these roles is expected to be more than 20 times the projected annual increase in net new jobs from 2022 to 2032.4

Skills and Training

Alternative education paths are becoming more popular and viable. Coding boot camps, online certifications, and vocational training programs offer specialized skills without the time and financial commitment of a four-year degree. These programs can be a faster and less expensive route into the workforce (BestColleges, n.d.).5

Caution: Be wary of predatory programs that promise quick results but don’t deliver quality education or job placement. Research and verify the credibility of any alternative education program before enrolling.

Kemetic. M.

Career Advancement

In today’s competitive job market, career advancement is more attainable than ever, especially for those who pursue further education with employer support. Many companies recognize the value of skilled, knowledgeable employees and offer programs to help their staff develop professionally. This commitment to employee growth can lead to higher salaries, promotions, and enhanced job security. Here are some ways career advancement can be achieved through employer-sponsored education:

- Skill Development Programs: Employers may offer workshops or courses to improve skills like project management or data analysis.

- Certification Reimbursement: Many companies reimburse employees for earning certifications relevant to their roles, such as technical certifications or licenses in healthcare or IT.

- Tuition Assistance: Some employers provide tuition assistance or cover some of the costs for degree programs that can advance an employee’s expertise in their field.

- Mentorship and Leadership Training: Structured mentorship and development programs can help employees prepare for higher-level roles.

- On-the-Job Training: Opportunities to learn directly in the workplace, like apprenticeships or specialized training programs, can make employees more competitive for advanced positions.

This support benefits both the employee by enhancing their career prospects and the employer by building a more skilled workforce.

Personal and Social Considerations

A. Personal Development

College presents vast opportunities for personal growth, nurturing critical thinking, problem-solving, and practical networking skills. The college experience goes beyond academics, offering social benefits like forming lifelong friendships and building a network of professional connections.

B. Social Mobility

Higher education has long been a pathway to upward social mobility. Yet, with the rising costs of college and the increasing burden of student debt, this advantage is no longer guaranteed for all. It’s crucial to consider whether the potential for social advancement justifies the financial commitment involved (Fry et al, 2024).6

C. Community Impact

College graduates often give back to their communities through civic engagement, volunteering, and philanthropy. This active involvement helps strengthen social cohesion and enhance the quality of life within communities (Perin & Gellis, 2019).7

While high-profile entrepreneurs like Mark Zuckerberg, Bill Gates, and Steve Jobs are celebrated for their success without college degrees, their journeys are exceptional and not reflective of the broader population. These stories often overshadow the risks of not pursuing higher education and its proven benefits.

Evaluating the Advice: Do You Need a College Degree?

Success Stories vs. Statistical Realities

Exceptional Cases: Mark Zuckerberg dropped out of Harvard to build Facebook, which became a global phenomenon. Similarly, Bill Gates and Steve Jobs left college to pursue their ventures, leading to extraordinary success. These individuals had unique visions, skills, and opportunities that are not typical for the average person.

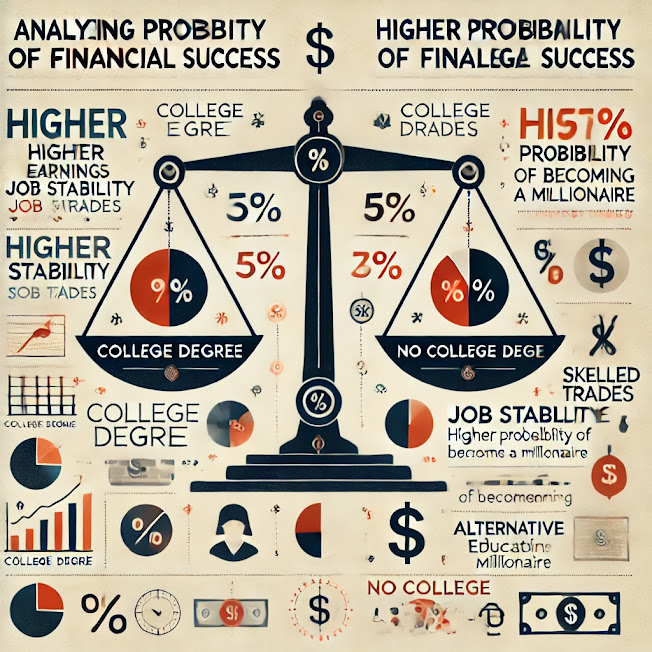

Statistical Realities: Most millionaires in the U.S. have a college degree. Higher education increases the likelihood of securing stable, well-paying jobs and accumulating wealth over time. According to the U.S. Census Bureau, individuals with a bachelor’s degree earn significantly more and have lower unemployment rates than those without a degree (U.S. Bureau of Labor Statistics, 2024).

Analyzing the Probability of Financial Success

Becoming a Millionaire

- With a Degree: Approximately 88% of U.S. millionaires have at least a bachelor’s degree, indicating a strong link between higher education and wealth accumulation (Sabatier, 2024).8

- Without a Degree: While becoming a millionaire without a college degree is possible, the probability is lower. Success in this category often comes through entrepreneurship or skilled trades, which can involve higher risks (Mancini, 2023).9

Securing a Well-Paying Job

Employment and Income: College graduates typically enjoy higher earning potential, excellent job stability, and lower unemployment rates than those without degrees (U.S. Bureau of Labor Statistics, 2024).10

Key Considerations

Career Goals: Choose an educational path that aligns with your career ambitions. Fields like healthcare, technology, and engineering generally require a college degree for entry (U.S. Bureau of Labor Statistics, 2024).

Financial Planning: Weigh the long-term economic benefits of a college degree against its initial costs. Although student debt can be challenging, the boost in lifetime earnings often offsets the upfront investment.

Alternatives to College: Consider vocational training, apprenticeships, or online certifications. These paths may better fit your career goals and financial situation (BestColleges, n.d.).

Conclusion

Deciding on college in 2024 requires careful consideration of financial factors, career goals, and personal interests. Higher education offers increased earning potential and personal growth, but balancing these benefits with costs and exploring alternative paths is crucial. The best decision is tailored to your individual goals and circumstances—there’s no one-size-fits-all solution.

References

- Torpey, E. (2021, June 22). Education pays, 2020. U.S. Bureau of Labor Statistics. https://www.bls.gov/careeroutlook/2021/data-on-display/education-pays.htm ↩︎

- U.S. Bureau of Labor Statistics. (2024, June 7). The Employment Situation — May 2024 (USDL-24-1234). https://www.bls.gov/news.release/archives/empsit_06072024.pdf ↩︎

- Greenberg, E., Schaefer, E., & Weddle, B. (2024, April 9). Tradespeople Wanted: The Need for Critical Trade Skills in the U.S. McKinsey & Company. https://www.mckinsey.com/capabilities/people-and-organizational-performance/our-insights/tradespeople-wanted-the-need-for-critical-trade-skills-in-the-us ↩︎

- Greenberg, E., Schaefer, E., & Weddle, B. (2024, April 9). Tradespeople wanted: The need for critical trade skills in the US. McKinsey & Company. https://www.mckinsey.com/capabilities/people-and-organizational-performance/our-insights/tradespeople-wanted-the-need-for-critical-trade-skills-in-the-us ↩︎

- BestColleges. (2023, May 24). 7 benefits of attending trade school. BestColleges. https://www.bestcolleges.com/trades/7-benefits-trade-school/

Sources ↩︎ - Fry, R., Braga, D., & Parker, K. (2024, May 23). Is college worth it? Pew Research Center. https://www.pewresearch.org/social-trends/2024/05/23/is-college-worth-it-2/ ↩︎

- Perrin, A. J., & Gillis, A. (2019). How College Makes Citizens: Higher Education Experiences and Political Engagement. Socius. https://doi.org/10.1177/2378023119859708 ↩︎

- Sabatier, G. (2024, April 9). Millionaire Statistics for 2024. Millennial Money. https://millennialmoney.com/statistics-about-millionaires/ ↩︎

- Mancini, J. (2023, May 8). 79% of Millionaires Are Self-Made—Lessons from Those Who Built Wealth Without Inheritance. Yahoo Finance. https://finance.yahoo.com/news/79-millionaires-self-made-lessons-160025947.html ↩︎

- U.S. Bureau of Labor Statistics. (2024). Education level and projected job openings. U.S. Department of Labor. https://www.bls.gov/careeroutlook/2024/article/education-level-and-projected-openings.ht ↩︎

Leave a Reply